- Connect your Web3 wallet (MetaMask, WalletConnect, etc.) to the platform

- Deposit stablecoins (USDT, USDC) as margin for your trades

- Browse available markets including crypto, forex, commodities, and indices

- Select your desired leverage (up to 500x for crypto, 1000x for forex)

- Open your first position and start trading

Decentralized Multi-Asset

Leveraged Trading

Trade crypto, forex, commodities & indices with up to 1000x leverage on a fully decentralized platform. Experience the future of perpetual trading with Levare Protocol.

our top partners

our top partners

How It Works

Create Wallet

Secure your digital assets effortlessly.Join now for peace of mind.

Create Account

Get started in seconds. Sign up for your account effortlessly with us today.

Register

Begin your journey swiftly. Sign up now and access limitless with ease.

Start Trading

Dive in now. Seamlessly begin your trading journey with us endless possibilities.

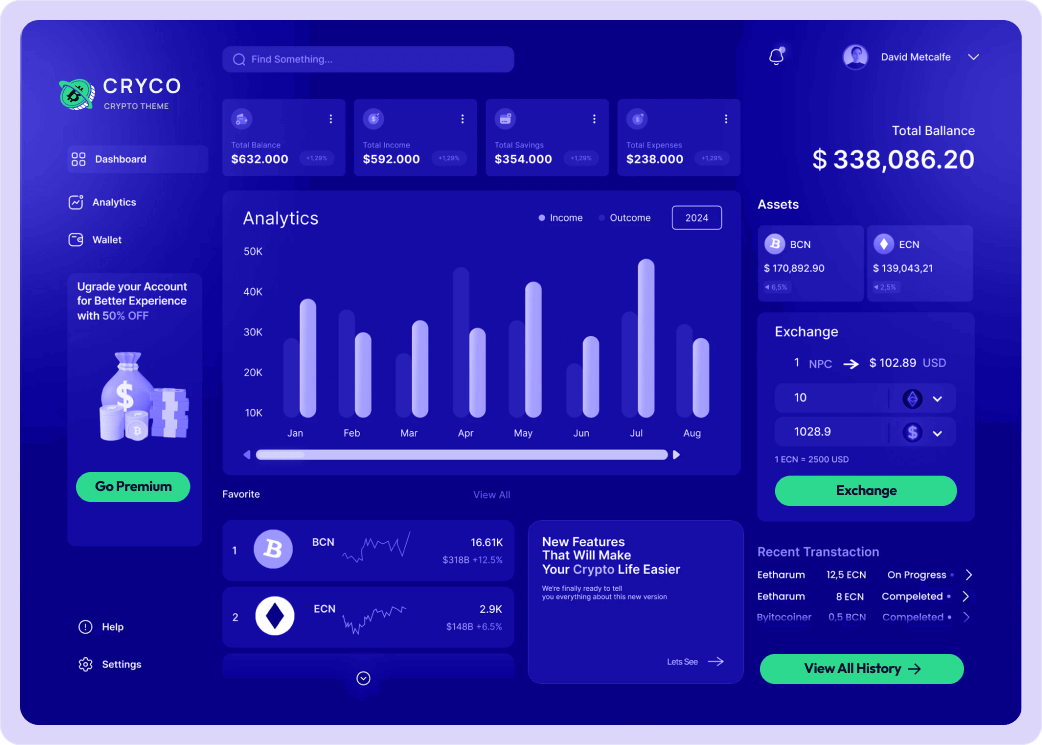

Revolutionary Features Powering the Future of DeFi Trading

Multi-Asset Leverage Trading

Trade cryptocurrencies, forex, commodities, and indices with up to 1000x leverage on a single platform. Access traditional and digital markets seamlessly.

Cross-Chain Liquidity Vault

Unified liquidity across multiple blockchains with automated risk management. Deep liquidity pool serves as counterparty for all trades.

DAO Governance & Community

Fully decentralized governance powered by LVR token holders. Community-driven decisions for protocol upgrades, asset listings, and parameter adjustments.

Advanced Risk Management & Security

Multi-layered risk controls with automated liquidation, oracle price feeds, and three-tier LP risk stratification. Audited smart contracts ensure maximum security.

00K+

Happy Clients00%

Customer Saatisfaction00K+

Sucessful Project00%

Security CertificationLive Trading Pairs

Across Multiple Assets

What Our Community Says

5.0

5.0

4.8

4.8

5.0

5.0

Multi-Chain Deployment

Across Leading Networks

LVR Token Economics

Fixed supply of 10 trillion tokens with strategic distribution for sustainable growth

Community Incentives

50% of total supply reserved for community rewards, liquidity mining, and ecosystem growth incentives.

Early Investors & Team

35% allocated to early investors (20%) and team/advisors (15%) with vesting schedules for long-term alignment.

Ecosystem & Security

15% dedicated to ecosystem development (10%) and security reserves (5%) ensuring platform stability and growth.

Token Generation & Allocation (TGA)

Detailed breakdown of LVR token distribution and vesting schedules

| Allocation Category | Percentage | Token Amount | Vesting Period | Initial Release | Purpose |

|---|---|---|---|---|---|

| Community Incentives | 50% | 5,000,000,000,000 | 4 years | 15% | Liquidity mining, staking rewards, ecosystem growth |

| Early Investors | 20% | 2,000,000,000,000 | 2 years | 10% | Seed & private sale funding |

| Team & Advisors | 15% | 1,500,000,000,000 | 3 years | 10% | Core team, advisors, future hires |

| Ecosystem Fund | 10% | 1,000,000,000,000 | 5 years | 25% | Partnerships, integrations, grants |

| Security Reserve | 5% | 500,000,000,000 | No vesting | 35% | Emergency funds, insurance pool |

| Total Supply | 100% | 10,000,000,000,000 | - | - | Fixed maximum supply |

Governance Rights

Vote on protocol upgrades and fund allocation through DAO governance.

Fee Discounts

Up to 50% trading fee discounts based on LVR holdings and staking levels.

Staking Rewards

Earn protocol fee dividends and provide security backing for the vault system.

Deflationary

Regular token buybacks and burns create deflationary pressure over time.

Development Roadmap

Our journey to revolutionize decentralized derivatives trading

Foundation & Testing

Complete core functionality development, launch Testnet public beta, conduct security audits and bug bounty programs.

- Smart contract development completion

- Testnet launch with early user testing

- Security audits and formal verification

- Community feedback integration

Mainnet Launch

Official mainnet deployment on Ethereum L2 with initial asset support and liquidity provision mechanisms.

- Mainnet deployment on Base/Arbitrum

- 20+ crypto and forex trading pairs

- Three-tier LP risk vault launch

- LVR token distribution and governance activation

Cross-Chain Expansion

Multi-chain deployment with unified liquidity and expanded asset coverage including commodities and indices.

- Deployment on BNB Chain, Polygon

- Cross-chain bridge integration

- Commodities and indices trading

- First seasonal trading competition

Ecosystem Enhancement

Mobile optimization, AI trading assistants, and global community expansion with comprehensive language support.

- Mobile-friendly interface launch

- AI trading assistant beta

- Multi-language support

- Global trading championships

Full Decentralization

Complete transition to DAO governance with developer ecosystem maturity and $10B+ trading volume target.

- Full protocol control to DAO

- Developer hackathons and SDK release

- $10B+ cumulative trading volume

- Multi-chain ecosystem completion

Frequently Asked Questions

-

Q1: How do I get started with trading on your platform?Getting started with Levare Protocol is simple and straightforward:

-

Q2:What assets can I trade on Levare Protocol?

- Major Cryptocurrencies (BTC, ETH, etc.)

- Forex Pairs (EUR/USD, GBP/USD, etc.)

- Commodities (Gold, Silver, Oil)

- Stock Indices (S&P 500, NASDAQ)

-

Q3:Is there a mobile app available for trading?

Levare Protocol is fully accessible on mobile devices through our responsive web interface. You can access all trading features directly from your mobile browser.

- Mobile Web Access: Our platform is fully optimized for mobile browsers, providing a seamless trading experience on iOS and Android devices

- Native Mobile Apps: Native mobile applications for iOS and Android are currently in development and expected to launch in Q3 2026

- Wallet Integration: Connect mobile wallets like MetaMask Mobile, Trust Wallet, or Coinbase Wallet for secure trading on the go

-

Q4:What are your trading fees?

Levare Protocol offers competitive trading fees with discounts available for LVR token holders:

- Maker Fees: Starting from 0.02% (reduced for market makers providing liquidity)

- Taker Fees: Starting from 0.05% (standard rate for market takers)

- Fee Discounts: Holders of LVR tokens can enjoy up to 50% trading fee discounts based on token holdings and staking levels

- Liquidity Providers: LP providers receive a share of trading fees as rewards

- No Deposit/Withdrawal Fees: Free deposits and withdrawals on supported networks

-

Q5:How long do deposits and withdrawals take?

As a decentralized protocol, Levare processes deposits and withdrawals on-chain, with timing depending on the blockchain network:

- Deposits: Near-instant confirmation once your blockchain transaction is confirmed (typically 1-5 minutes depending on network congestion)

- Withdrawals: Processed immediately via smart contract execution, subject to blockchain confirmation times

- Supported Networks: Ethereum, Base, Arbitrum, BNB Chain, Polygon, and other supported Layer 2 networks

- No Manual Processing: All transactions are automated through smart contracts - no waiting for manual approval

- Cross-Chain Support: Deposit on any supported chain and trade seamlessly with unified liquidity